We have received many questions from clients regarding the treatment of pass-through entities (partnerships, LLCs, S corporations and sole proprietorships) under the Tax Cuts and Jobs Act (TCJA). To help clients understand the new deduction for pass-through entities, we have put together this article. If you have any questions regarding the treatment of pass-through entities under the TCJA or need assistance in forming, dissolving or administering a pass-through entity, the attorneys at Allison & Mosby-Scott can help. Please call us at 309-662-5084 or visit our website at www.allisonmosby-scott.com.

Search Article Library

Recent Articles

- AMS Welcome Thomas Sanner August 28, 2023

- The Advantage of Having a Will and Power of Attorney July 21, 2023

- Errors to Avoid While Applying for your Visa July 13, 2023

- AMS welcomes Attorney Whitney Leifheit March 24, 2023

- Cohabitation Agreements March 10, 2023

Related Posts

BusinessBusiness & Commercial LawEstate PlanningEstate PlanningFeaturedGeneralGeneral Civil/Criminal Law

BusinessBusiness & Commercial LawEstate PlanningEstate PlanningFeaturedGeneralGeneral Civil/Criminal Law

Transfer of Property upon Death

Lisa DorchMarch 10, 2022

BusinessBusiness & Commercial LawFeaturedGeneralRisk Management

BusinessBusiness & Commercial LawFeaturedGeneralRisk Management

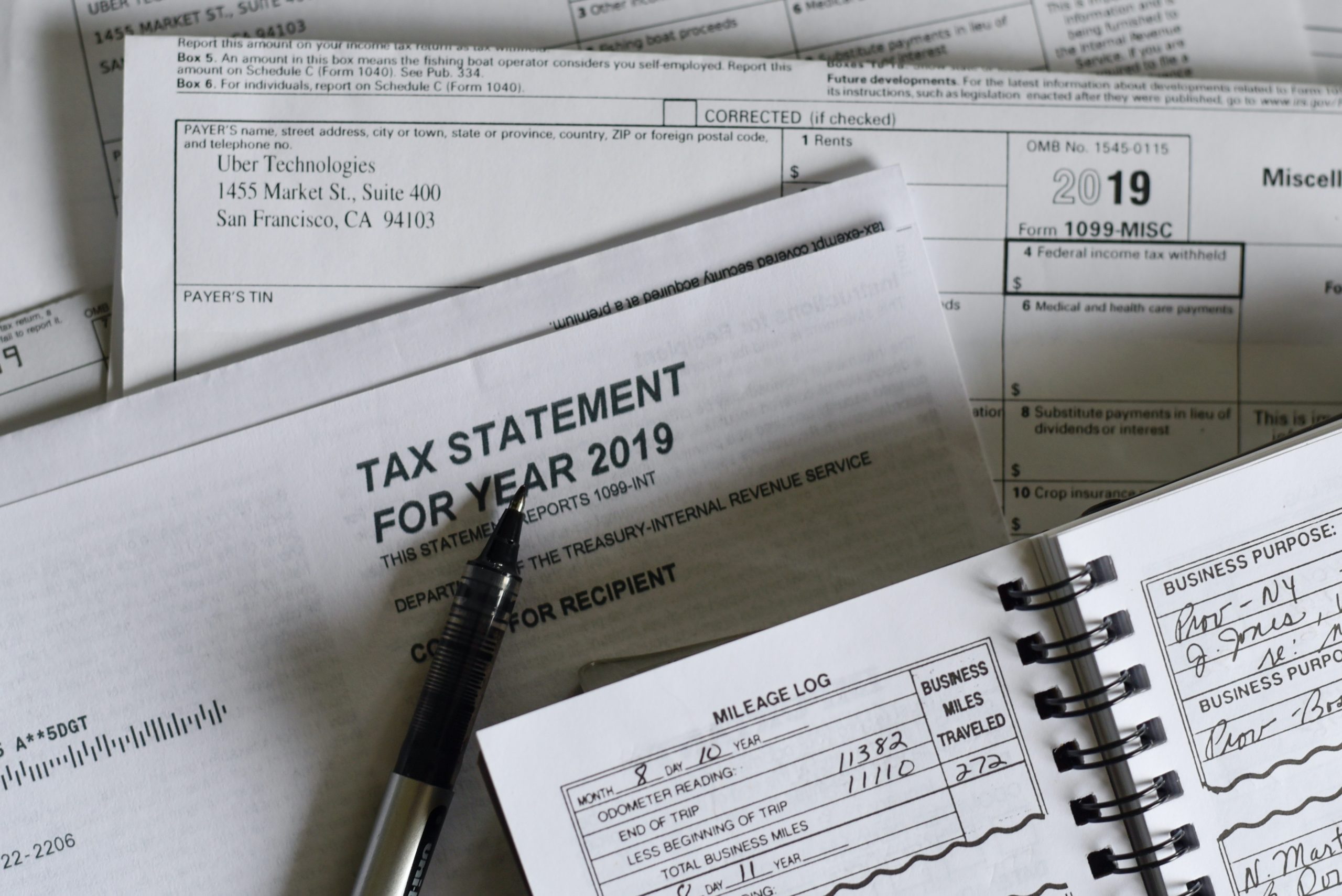

Standard Mileage Rates Go Up in 2022

Lisa DorchJanuary 27, 2022

BusinessBusiness & Commercial LawCovid-BusinessFeaturedGeneralRisk Management

BusinessBusiness & Commercial LawCovid-BusinessFeaturedGeneralRisk Management

Shareholder Meetings Go Virtual

Lisa DorchJanuary 20, 2022