The Tax Cuts and Jobs Act became Public Law No. 115-97 on December 23, 2017 when it was signed into law by President Trump. The Act amends the Internal Revenue Code of 1986 and is biggest change to US tax law since the 1986 law was passed. The Act makes substantial changes to tax law for both individual and corporations. Allison & Mosby-Scott has prepared this summary to help our clients understand the changes in the Act that impact our clients. If you have any questions on how this affects your business or you personally, please call the attorneys at Allison & Mosby-Scott at 309-662-5084.

Search Article Library

Recent Articles

- AMS Welcome Thomas Sanner August 28, 2023

- The Advantage of Having a Will and Power of Attorney July 21, 2023

- Errors to Avoid While Applying for your Visa July 13, 2023

- AMS welcomes Attorney Whitney Leifheit March 24, 2023

- Cohabitation Agreements March 10, 2023

Related Posts

BusinessBusiness & Commercial LawEstate PlanningEstate PlanningFeaturedGeneralGeneral Civil/Criminal Law

BusinessBusiness & Commercial LawEstate PlanningEstate PlanningFeaturedGeneralGeneral Civil/Criminal Law

Transfer of Property upon Death

Lisa DorchMarch 10, 2022

BusinessBusiness & Commercial LawFeaturedGeneralRisk Management

BusinessBusiness & Commercial LawFeaturedGeneralRisk Management

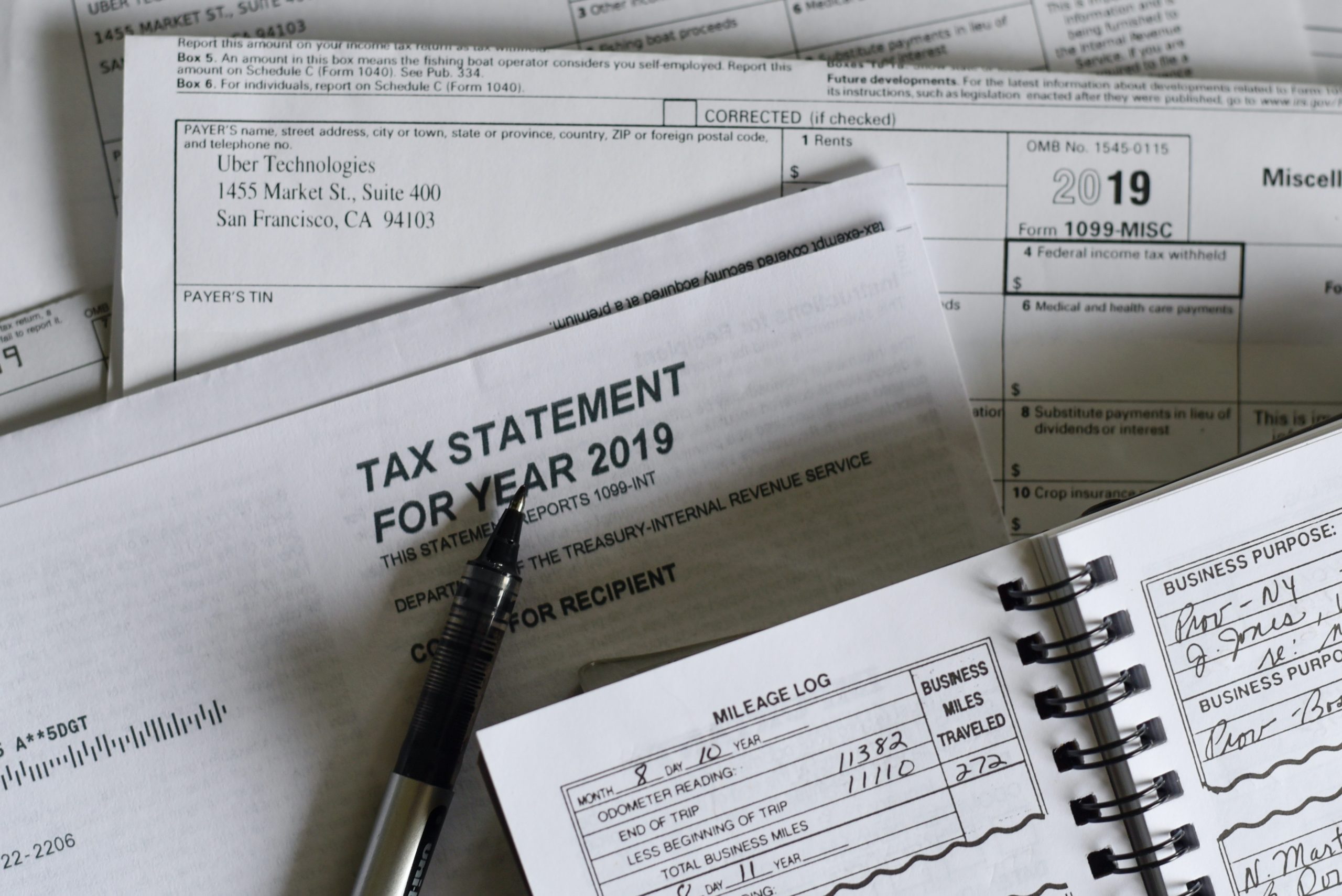

Standard Mileage Rates Go Up in 2022

Lisa DorchJanuary 27, 2022

BusinessBusiness & Commercial LawCovid-BusinessFeaturedGeneralRisk Management

BusinessBusiness & Commercial LawCovid-BusinessFeaturedGeneralRisk Management

Shareholder Meetings Go Virtual

Lisa DorchJanuary 20, 2022